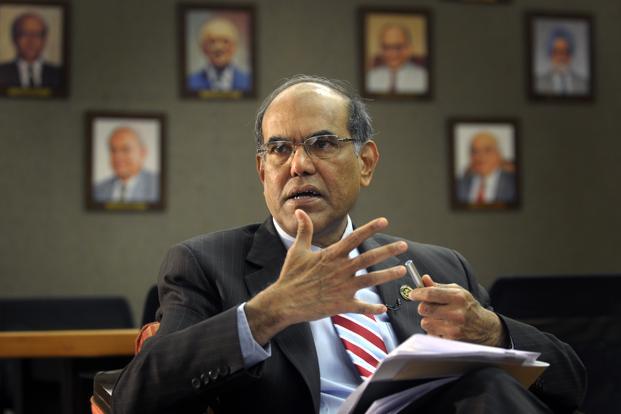

Mumbai: Reserve Bank of India governor D. Subbarao said the central bank is as much worried about growth as inflation but the time is not ripe for a rate cut. A cut in banks’ cash reserve ratio (CRR), according to him, is balancing between slowing growth and rising inflation.

In an interview, Subbarao also explained the central bank’s concerns about growing restructured assets of the banking system. Edited excerpts:

You seem to be more worried about high inflation than slowing growth. Why did you cut banks’ cash reserve ratio (CRR) then?

First of all, I want to say that we are equally worried about high inflation and slowing growth. It’s not correct to say that growth slowdown is not a worry for us. We believe that the Reserve Bank must respond to that…but we also need to restrain inflation… What we are doing is balancing between slowing growth and rising inflation.

We expect that inflation will rise further before it comes down in the fourth quarter of this year. So we need to time and calibrate our policy actions to the inflation trajectory.

If you could cut CRR, why didn’t you go for a repo rate cut? By cutting CRR, you are adding liquidity which is inflationary.

Yes, CRR cut is expansionary, but that expansion is neither automatic nor immediate. It is not automatic because it depends on credit creation and that credit creation takes time. So, CRR is less expansionary than what people think. Normally, people think it releases five times money but it doesn’t happen immediately. It takes several credit cycles. So, it is not as expansionary as you think.

There are a number of factors which are constraining liquidity. Some of them are structural such as the wedge between deposit and credit growth and others are cyclical or temporary factors such as the festival demand and the build-up in government’s cash balances with RBI. Our assessment was that both the structural and cyclical factors will take time to resolve—may be a few months. At the same time, we wanted to ensure that liquidity is comfortable so that at the current repo rate, the transmission does take place.

Does that mean that you expect banks to cut their loan and deposit rates?

Yes, to the extent that it enables them to do so. We expect that there is a greater room for banks to cut their lending rate now than before the CRR cut and we expect that lending rates are cut, especially in those sectors of the economy where there are supply constraints.

So, the CRR cut is not a compromise? It seems you have chosen this path as a conflict-resolution mechanism as the finance ministry was very keen on a rate cut.

I don’t think you should read it as a conflict-resolution mechanism or conflict-resolution package. You should see this as the Reserve Bank’s response to the current growth-inflation dynamics and our best efforts to support flow of credit to the productive sectors of the economy even as we restrain inflation.

This is the second time since July you have changed your growth and inflation projections. How certain are you that the latest figures are final and there won’t be any changes?

This is our best estimate at this point of time and we have given the projections, along with the diagram which shows probability distribution of growth projections. We will revisit the numbers in January. The diagram gives probability distribution…and you must understand that there are a lot of uncertainties around the world and in India. Growth picking up depends critically on investment taking off. There are a number of factors that have to get in place for investment to take off.

Why did you have to give guidance in these uncertain times?

I don’t think we should avoid this. Everybody gives guidance. People give different types of guidance. Bank of Canada was the first to give a definitive guidance back in 2008. The US Federal Reserve has given a definitive guidance for keeping rates low till 2015. So, I don’t think on the quality of guidance or the language of guidance, we are different. In fact, we are trying to do that as a best practice.

Now, in uncertain times, giving guidance becomes difficult. But this is when you need to give guidance. The market demands guidance from you. Our problem so far has been that our guidance has been read as an irrevocable commitment, not as guidance, based on certain factors. You will see that there is a last sentence (in guidance) as a caveat—monetary easing is conditional on growth and inflation evolving according to our assessment. To summarize, that we believe that giving guidance is important and it adds value so that people can take informed decisions. I don’t think we are unique in this. The content and the language of the guidance will depend on the country context.

You don’t see an entrapment?

I don’t see this as an entrapment. I would feel more comfortable if I did not have to give guidance. But I believe that we are adding value to macroeconomic management by giving guidance. So even as it is less comfortable for us, we are doing it.

In the context of growth-inflation dynamics, is this the toughest policy ever in your career?

Every time I keep thinking that this is the toughest. By the time I leave the Reserve Bank, I will leave at the cliff of my challenging decisions.

You have raised the provisions for restructured standard assets. How worried are you about the quality of assets in the banking system?

Well, it is a matter of increasing concern. You know the numbers. The NPA (non-performing assets) level has gone up from 2.9% to 3.2%. The restructured standard assets have also been growing. There have been concerns expressed that our regulatory forbearance on giving standard asset classification to restructured assets is not that consistent with the international best practice; also not in the interest of our banking system. Therefore, we have gone with the Mahapatra committee recommendations, which are there.

But to believe that all restructured assets are going to become NPAs, I think, is the other extreme view. The slippage ratio form restructured assets has been increasing. That might increase a little more. So, the direction of movement and the rate of movement of increasing NPAs and increasing restructured assets is a matter of concern.

This is happening because of the economic downturn and there is not enough tightness or effectiveness in banks’ credit appraisal, monitoring and early recognition of problems. In today’s meeting, we told banks to take care of factors which are controllable. There are factors which are beyond our control—we have to take them as given and manage them.

You are silent on new banking licences. When do we expect to see the first set of new banks?

Indeed, it has been a long time and people are right to be questioning us about this but you know the current status…We want certain additional powers and authority to initiate the process. We were given to understand that an amendment in the Banking Regulation Act is necessary in order to give us the additional powers.

More recently, I have seen reports in the media that the government is considering whether these powers can be given even without the amendment. We will have to wait and see.

Finally, the finance ministry had been pushing for a rate cut but you did not budge. Won’t your action affect the relationship between the regulator and the finance ministry?

I don’t think so. This is a constructive relationship. Sometimes there is disappointment, disagreement…But I don’t think it will affect the professional relationship between the Reserve Bank and the government to pursue our objectives.