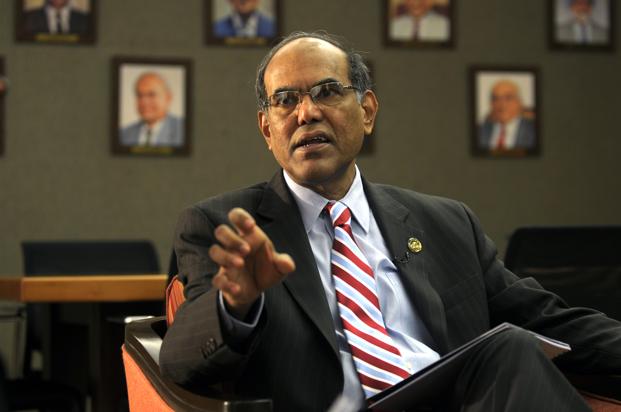

There could not have been a better choice than Raghuram Rajan as successor to D. Subbrao as the 23rd governor of the Reserve Bank of India.

Subbarao steps down on 4 September. Within a fortnight of Subbarao’s taking over as India’s chief money man, US investment bank Lehman Brothers Holdings Inc. collapsed, plunging the world into an unprecedented credit crisis. Subbarao brought down the policy rate to a record low and flooded the system with money to ward off the effects of the credit crunch. Later, when Asia’s third-largest economy started seeing the rise of inflation, Subbarao raised the policy rate a record 13 times before pressing the pause button.

Before he could go the whole hog on monetary easing, encouraged by low inflation, a depreciating rupee played spoilsport.

At this juncture, Rajan’s task is cut out for him. Here are five things that he needs to do:

1. He needs to take firm action to stabilise the currency market and stem the runaway depreciation of the rupee. The local currency hit its lifetime low of 61.81 a dollar on Tuesday.

2. He needs to roll back the liquidity tightening measures that RBI has taken over the past few weeks to drain liquidity in the system and increase the cost of money. This cannot be done overnight but he should have a plan on his table. It needs to be linked to a firm plan for stemming the fall of the rupee –both monetary and fiscal.

3. After the roll back, there must be a plan to resume monetary easing, depending on the macroeconomic scenario. It’s not easy to take a call on this now, but the lowering of the interest rate is imperative to revive growth.

4. Even though both wholesale price inflation and the so-called core inflation or the non-food, non-oil, manufacturing inflation are low and well within RBI’s comfort zone, retail inflation continues to be very high. That’s a big headache for RBI, and could stay the bank’s hand when it comes to easing monetary policy. Rajan needs to take care of that.

5. Finally, Rajan needs to rebuild the market’s confidence in the banking regulator. RBI’s actions in the past few weeks and the reaction of the market have make it abundantly clear that the market has no confidence in the central bank. Rajan’s biggest task will be making the market listen to the regulator.

To be sure, many of these things cannot be done by RBI alone. Both monetary and fiscal policies must work hand in hand. With a new guard at the RBI, I am sure things will change for the better.