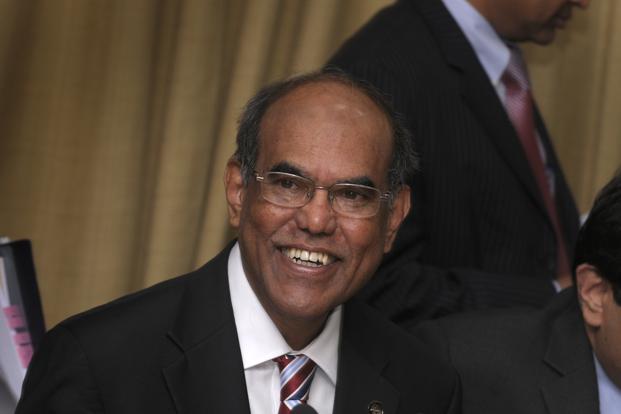

On 30 May, Reserve Bank of India (RBI) governor D. Subbarao warned of upside risks to inflation and expressed worries over the high current account deficit. That sent bond yields to a two-week high and the local currency to a 10-month low. “Growth is significantly moderated, inflation is somewhat off its peak, but there are several upside risk factors, the balance of payments is under stress and investments have to pick up,” Subbarao said in Ahmedabad.

The next day, the last trading day of the past week, BSE’s bellwether equity index Sensex fell 455 points and media reports claimed that Subbarao’s statement on RBI being concerned about the country’s widening current account deficit and still-high retail inflation had dented hopes for a further rate easing and spooked investors who rushed to sell rate-sensitive stocks.

Exactly two weeks ago, on 15 May, India’s benchmark stock indices rose to their highest levels since January 2011 and government bond prices rose and yields dropped to their lowest in more than three years. That time, the trigger was Subbarao’s statement the he would consider softening inflation while deciding on policy action on 17 June, when the central bank is due to announce its mid-quarterly policy for fiscal 2014.

In Frankfurt, Subbarao had said, “Reserve Bank of India would take into account falling inflation while deciding on policy initiative in its review next month…. We certainly will take note of the softening of inflation and the external payments situation in the next mid-quarter policy statement on 17 June.”

In both instances, Subbarao made general statements that he would take into consideration both the fall in inflation as well as trade and that high current account deficit and retail inflation are a worry. It’s very much like a medical practitioner saying too much of stress can lead to diabetes or smoking can cause cancer. But Subbarao is no medical practitioner and knows that television channels in India carry tickers with “RBI is keeping a close tab on inflation: Governor” as breaking news. (Last week, an anchor of a business channel asked an economist whether she agrees with the meteorological department’s observation that monsoon will come on time in India).

In Ahmedabad, Subbarao said the current account deficit, which hit a record high of 6.7% of India’s gross domestic product (GDP) in the December quarter on heavy oil and gold imports, would be a key factor in monetary policy decisions. He stated the obvious, but markets chose to react the way they wanted. That leads us to the crux of the matter: Does the governor need to talk on inflation and current account deficit, both market-moving subjects, however innocuous his statements are. RBI has an annual monetary policy, a six-monthly review of the policy, four quarterly policy reviews and yet another set of semi-quarterly reviews every six weeks. And all of them are the governor’s statements. Why would he need to talk from other platforms frequently when he knows that the vanilla statements can be interpreted differently and the media and the market are capable of selective reporting and reaction.

Come on governor, let your deputies do the talking—if at all that’s necessary. You should have fun letting the market read your lips while keeping silent outside the monetary policy and over half-a-dozen reviews of the policy strewn over a year.