Listed Indian banks’ gross bad loans crossed Rs7 trillion in the December quarter. This is no nasty surprise. In fact, the December Financial Stability Report of the Reserve Bank of India (RBI) warned that gross bad loans of banks might rise further and public sector banks would be the worst hit. Gross bad loans of the Indian banking industry as a percentage of loans rose to 9.1% in September, from 7.9% in March. If one includes restructured loans, the overall stressed assets to advances ratio was 12.3% in September. In the December quarter, it rose further even though the pace of growth has slowed at many banks.

While enough is being written on the overall health of the Indian banking system, it may not be a bad idea to sift through data and identify the worst-affected state-owned banks, a few of which are fast losing their relevance in the financial system. For this purpose, I have looked at data over the past six quarters—between September 2015, a quarter before the clean-up drive started, and December 2016.

Between August and December 2015, RBI inspectors pored over the loan books of all banks as part of a first-of-its-kind asset quality review (AQR) and asked them to set aside money for three kinds of loans—non-performing assets (NPAs) that they had not recognized yet; loans given to projects where the dates of commencement of commercial operations had passed but the projects had failed to take off; and restructured loans.

The banks had to provide for the first two types of loans in two phases in the December and March quarters of fiscal year 2016, at least 50% each. For restructured loans, they were asked to make 15% provision in six quarters, 2.5% each, till March 2017. While we will have to wait till March when the entire clean-up exercise gets over, a few banks have already exposed their vulnerability. Ashwin Ramarathinam of Mint Research Bureau has collated the data from Capitaline Database and press releases and analysts’ presentations made by individual banks.

The idea is not to create panic. Indeed, depositors’ money is safe with these banks but besides taking deposits, a bank’s primary job is to give loans and support economic growth. A few public sector banks are no longer capable of doing this.

The first obvious health-check parameter is bad loans.

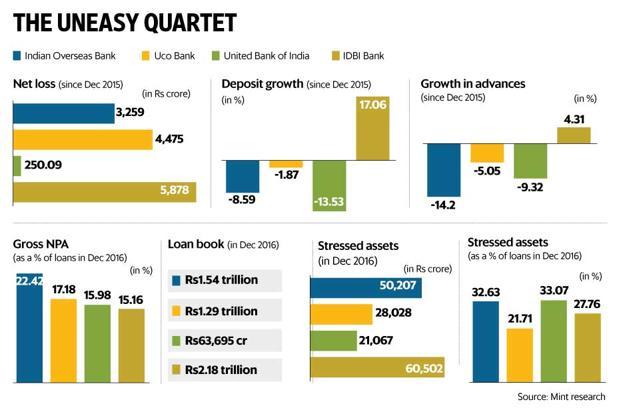

Indian Overseas Bank (IOB) has the ugliest balance sheet among public sector banks. Its bad loans were 22.42% of loan assets in December 2016, more than double the 11% in September 2015—just before the first impact of AQR was seen in banks’ balance sheets. Uco Bank’s gross NPAs are 17.18% and both United Bank of India’s and IDBI Bank’s gross NPAs are well over 15%—all have doubled since September 2015.

In absolute terms, during this period, gross NPAs of IOB rose from Rs19,424 crore to Rs34,502 crore. For Uco, the rise has been from Rs12,227 crore to Rs22,181 crore; and United Bank of India, from Rs6,112 crore to Rs10,845 crore. For IDBI Bank, gross NPAs more than doubled from Rs14,758 crore to Rs35,245 crore.

However, this is only half the story. We need to look at the overall stressed assets, including restructured loans, a sizable portion of which is unlikely to be recovered. In December 2016, the stressed assets of IOB were Rs50,207 crore, Uco Bank Rs28,028 crore, United Bank of India Rs21,067 crore and IDBI Bank Rs60,502 crore. As a percentage of total loan assets, roughly one-third of all loans of United Bank of India (33.07%) and IOB (32.63%) are stressed. For IDBI Bank, this ratio is 27.76% and Uco, 21.71%.

Even this does not reveal the real state of affairs. Banks periodically write off loans, and many such write-offs are the so-called “technical write-offs”, a typical Indian concept whereby a bad loan is taken off the balance sheet of a bank but parked in a branch and the recovery process continues. Banks do get tax benefits on recovered bad loans, and this also depresses their NPA figures. Only after adding the written-off loans to the stressed assets do we get to know how bad a bank’s health is.

By making massive provisions, most banks have been able to bring down their net NPAs. In the past six quarters, IOB had provided for Rs9,804 crore, Uco Rs8,771 crore, United Bank of India Rs2,999 crore and IDBI Bank Rs15,160 crore. With the slowing of fresh bad loans accumulation, the amount of money set aside for bad loans is progressively going down for most banks but not these four. Provisioning hits profits and erodes capital.

It may not be easy to make hefty provisions in the coming days as net interest income, or the interest earned on advances minus the cost of deposits, has been coming down for these banks and the so-called “other income”, which includes treasury profit, will take a hit with the rise in bond yields. The net interest income of IDBI Bank almost halved between September 2015 and December 2016, from Rs1,612 crore to Rs850 crore. For United Bank of India, the drop is from Rs639 crore to Rs361 crore; Uco, from Rs1,416 crore to Rs976 crore, while IOB’s fall in net interest income is marginally down—from Rs1,398 crore to Rs1,335 crore—after it dropped below Rs1,300 crore for two successive quarters.

What is worrisome is that while bad loans are ballooning, the loan books of three of these four banks have been shrinking. IOB’s loan portfolio shrank by 14% between December 2015 and December 2016 (Rs1.79 trillion to Rs1.54 trillion) and that of United Bank of India, over 9%. Uco’s loan book has shrunk 5% but IDBI Bank has managed to grow 4%. For IOB and UCO, deposit portfolios, too, have shrunk, while United Bank of India and IDBI Bank continue to garner fresh deposits. The government’s demonetization exercise which forced citizens to return old high-value notes in November-December helped banks grow deposits.

Higher provisions and a drop in interest income have hit their profitability. In the past five quarters since December 2015, IOB has made an accumulated loss of Rs3,259 crore in addition to a Rs551 crore loss in September 2015. Uco’s loss since December 2015 has been Rs4,475 crore. United Bank of India has managed to record small profits in four of the five quarters but still accumulated a Rs250 crore loss, while IDBI Bank’s accumulated loss in the past five quarters is Rs5,878 crore.

Indeed, all four banks have capital to meet the regulatory requirement for now but that’s small consolation. A look at the capital and reserves or net-worth of these banks and the pile of bad loans they have accumulated does not inspire much confidence. For IOB, gross NPAs are more than two-and-a-half times its net worth; both Uco and United Bank of India have bad loans at least double their net worth. IDBI Bank’s bad loans are 1.3 times its net worth.

If we look at their net worth against the backdrop of the stressed assets they have piled up, the scene is much worse. Both United Bank of India and IOB’s stressed assets are almost four times their net worth; for UCO, it is close to three times; and for IDBI Bank, over two times. Even net NPAs of IOB, United Bank of India and Uco are higher than their net worth. To be sure, apart from this quartet, quite a few other public sector banks are stressed and their return on assets and equity is in the negative zone. Bank of India and Oriental Bank of Commerce have seen marginal growth in deposits in the past one year; both of them as well as Central Bank of India, Bank of Maharashtra and Dena Bank have shrunk their loan books. Before posting small profits in the past two quarters, Bank of India had posted a more than Rs6,000 crore loss in four successive quarters. Central Bank of India recorded Rs3,582-crore loss in the past five quarters. For Allahabad Bank, the accumulated loss is Rs1,492 crore (in three of five quarters) and Dena Bank Rs1,278 crore (four out of five quarters). Stressed loans are one-fourth of Dena Bank’s loan book. Punjab National Bank and Andhra Bank also have deep pockets of stress. Even a relatively strong Bank of Baroda posted a Rs6,572 crore loss in the December 2015 and March 2016 quarters and its collective net profit in the next three quarters could make good roughly 20% of the losses. Its stressed loans are one-fifth of its overall loan book, which has shrunk almost 9% in the past one year and deposits haven’t grown at all.

While for a few well-capitalized banks, consolidation in balance sheet could be a strategic decision, for most, it betrays their vulnerability. They are too stressed on most parameters and, by not giving fresh loans (or, giving very selectively only to prevent old loans from going bad—the so-called “evergreening”), they are increasingly finding it difficult to justify why they should be around. Still, large-scale capital infusion in individual banks, consolidation or culling or even creation of a bad bank is unlikely to happen soon. The government will get out of the denial mode when it sees the investment demand picking up in a big way, corporate borrowers scrambling for credit, and the banking system is not able to support India’s growth.

Meanwhile, bank stocks continue to rise. In the past one year till last Friday, IDBI Bank stock has risen 55%, United Bank 36%, Uco 13% and IOB 11%. Perhaps the market knows more than (what) meets the eye.