Now that the Election Commission (EC) has given its nod to the Reserve Bank of India (RBI) to go ahead with its plan of issuing in-principle licences to a third set of new banks, when will the banking regulator issue the licences?

Well, it can happen as early as today. Typically, the committee of the central board of RBI meets every Wednesday. This is an empowered committee that can take all decisions. The committee could approve the proposals at today’s meeting.

How many licences one can expect?

Not too many. This is because RBI plans to give bank licences on tap hereafter. Personally, I think it could give its nod to a couple of names.

If indeed it issues only two in-principle licences, who will be the lucky winners?

My bet is on IDFC Ltd and Bandhan Financial Services Pvt. Ltd.

Does that mean the Bimal Jalan panel recommended only two names?

Not really. In fact, according to people familiar with the situation, the Jalan panel has not recommended any names. It has made a Swot (strengths, weaknesses, opportunities, and threats) analysis of all the candidates and explained the pros and cons.

Which are the strongest contenders, according to the Jalan panel?

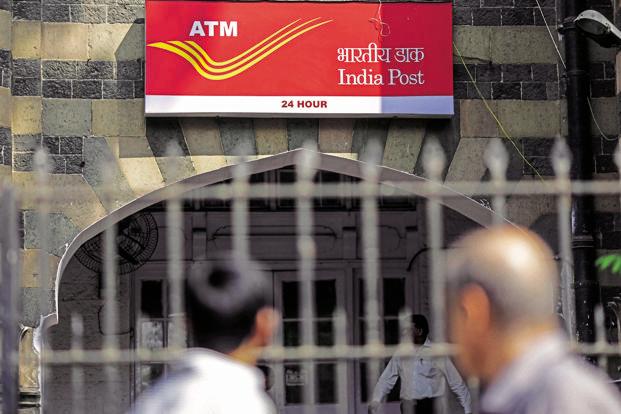

IDFC, Bandhan Financial Services, LIC Housing Finance Ltd, and Bajaj Finserv Ltd are the top four picks. India Post too is there but the government has not yet cleared the postal department’s plans for starting a bank. RBI may open another window for the government agency, giving it the status of a public sector bank. Among other applicants, L&T Finance Holdings Ltd seems to be there.

Who are the other members of the Jalan panel?

Former Securities and Exchange Board of India (Sebi) chairman C.B. Bhave, former RBI deputy governor Usha Thorat, and RBI board member Nachiket Mor.

When did the entire exercise start?

Former finance minister Pranab Mukherjee announced that a new set of private entities would be allowed to set up banks in February 2010.

How many companies have applied for a banking licence?

Twenty-five companies have applied for licences. The Tata group opted out after applying for it.

Who all are eligible to get a licence?

Only those with impeccable track records are being considered for a licence and any investigation by a regulatory agency into any entity will disqualify that entity. The candidates eligible to apply for a banking licence needed to have a 10-year track record and they should never have been under the scanner of any regulator, enforcement or investigative agencies. Note that all eligible applicants may not get the licence.

Who are major applicants?

The list of serious applicants includes corporate houses such as Aditya Birla Nuvo Ltd and Reliance Capital Ltd; financial intermediaries Edelweiss Financial Services Ltd, IFCI Ltd, Indiabulls Housing Finance Ltd, India Infoline Ltd, JM Financial Ltd, Magma Fincorp Ltd, Muthoot Finance Ltd, Religare Enterprises Ltd, Shriram Capital Ltd and SREI Infrastructure Finance Ltd; microfinance institution Janalakshmi Financial Services Pvt. Ltd; and public sector undertaking Tourism Finance Corp. of India Ltd. The Tatas opted out.

When will a successful applicant start its bank?

After receiving the in-principle licences, the successful applicants will have 18 months to finalize their business plans.

Why is the sector being opened up yet again?

In the past, the apex bank’s stated objective behind giving licences to new banks had been to introduce competition in the banking sector, largely dominated by government-owned banks. This time, its objective is to bring about greater financial inclusion in a nation where only 35% of adults have access to formal banking services, according to a 2012 World Bank working paper.

When did RBI release the final guidelines?

Three years after Mukherjee made the announcement in his February 2010 budget, RBI released the final guidelines on licensing norms in February 2013. The deadline for submission of applications was 1 July 2013.

When did RBI open up the banking sector for the first time?

RBI opened the doors for a set of new banks in January 1993.

What was the capital requirement in 1993?

The capital requirement was Rs.100 crore; in 2001, it was Rs.200 crore, to be raised to Rs.300 crore in three years. This time, it has been fixed at Rs.500 crore.

How many applications did it receive at that time?

It received 113 applications, many from large industrial houses.

Who scrutinized the applications?

Noted economist-bureaucrat Sharad Marathe, the first chairman of the erstwhile Industrial Development Bank of India, reviewed the first bunch.

How many new banks were set up in the first lot?

Nine new banks were set up and one cooperative bank was allowed to convert itself into a commercial bank. This list includes Global Trust Bank Ltd, ICICI Bank Ltd, HDFC Bank Ltd, UTI Bank Ltd (renamed Axis Bank Ltd), Bank of Punjab, IndusInd Bank Ltd, Centurion Bank Ltd, IDBI Bank Ltd, Times Bank and Development Credit Bank Ltd.

How have these entities fared?

Of these, Times Bank merged with HDFC Bank; Global Trust Bank was forced to merge with Oriental Bank of Commerce; and Bank of Punjab was acquired by Centurion Bank to form Centurion Bank of Punjab, which in turn was taken over by HDFC Bank.

When did RBI open up the sector for the second time?

In January 2001, RBI issued guidelines for the second set of new banks.

Who scrutinized the applications?

A a three-member committee comprising I.G. Patel, former RBI governor, C.G. Somiah, former comptroller and auditor general of India, and Dipankar Basu, former chairman of State Bank of India, did the job.

How many licences were issued?

Two licences were issued, including conversion of a non-banking financial company into a bank—Kotak Mahindra Bank Ltd and Yes Bank Ltd.

What next?

From now on, issuance of banking licence will not be a once-in-a-decade affair. RBI will fine-tune the guidelines and licences will be given on tap. There will also be differentiated licensing for entities such as payments banks, which are very different from universal banks.